Tired of forgetting where your money went? This app finally brought my spending into the light

We’ve all been there—staring at our bank balance, wondering where the month’s income disappeared. I used to dread checking my finances, not because I overspent, but because I simply didn’t know what I’d spent on. That changed when I started consistently tracking my purchases. It wasn’t just about numbers; it was about clarity, control, and peace of mind. This is the real story of how regular use of a simple spending tracker reshaped not just my budget, but my daily choices and long-term confidence.

The Moment I Realized I Was Blind to My Own Spending

It happened in the middle of a Tuesday, standing in front of the coffee display at my local grocery store. I held a bag of my favorite blend, staring at it like it was a riddle. Did I already buy this last week? Or was that the decaf? I couldn’t remember. And then it hit me—I didn’t just forget about coffee. I had no real idea what I’d spent money on all month. Not the small things, not the big things. I knew my rent was paid, the utilities were covered, but everything else? A blur.

I wasn’t careless with money. I didn’t max out cards or skip bills. But I also didn’t have a system. I paid with cards, tapped my phone, bought things online in five minutes flat—and never saw a full picture. My bank app showed numbers, but not stories. It didn’t tell me that I’d bought three different face creams in six weeks or that I’d spent more on takeout than I realized because each order was just a small amount. The problem wasn’t overspending—it was invisibility.

That moment in the grocery store wasn’t dramatic, but it was pivotal. I realized I was living blind to my own habits. And if I didn’t know where my money was going, how could I make better choices? How could I plan for things I really wanted—like a family trip, a kitchen upgrade, or just a little breathing room each month? That’s when I made a quiet decision: I would start seeing my spending, clearly and consistently. Not to punish myself, not to live with strict rules, but simply to bring light into the fog.

Choosing Simplicity Over Complexity: Why I Picked the Right App

I’ll admit, I started with big ambitions. I downloaded a few finance apps, opened spreadsheets, even tried jotting things down in a notebook. One app wanted me to set budgets for 17 different categories. Another asked me to link every account, then walked me through a 20-minute onboarding quiz about my financial goals. The notebook? I forgot it in my car after two days.

What I quickly learned was this: the more complicated the system, the less likely I was to stick with it. I wasn’t looking for a financial overhaul. I just wanted to *see* where my money was going without it feeling like homework. I needed something that fit into my real life—messy, busy, full of school runs, last-minute errands, and the occasional impulse buy on a tired afternoon.

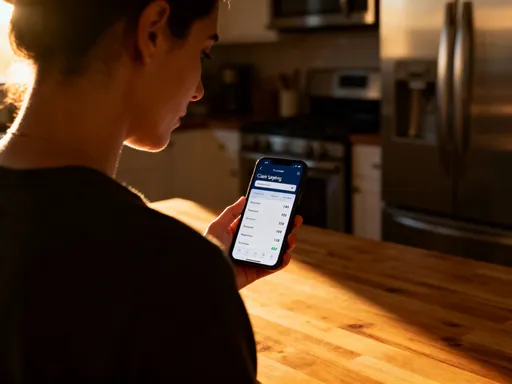

That’s when I found an app that felt different. It didn’t bombard me with charts or demand perfect data entry. Instead, it had a clean screen, a big button to log a purchase, and smart features that did the heavy lifting. When I paid for something with my card, the app noticed the transaction and asked, “Want to categorize this as groceries?” It learned from my choices. I could add a purchase in seconds—just tap, confirm, done. No typing long descriptions, no dragging sliders, no guilt-tripping pop-ups about overspending.

What sold me was how little effort it took. I didn’t have to be perfect. I didn’t have to spend 20 minutes every night balancing books. I just had to be consistent. And because it was easy, I actually did it. That’s when I realized the secret wasn’t in the app’s features—it was in the design. It respected my time, my energy, and my reality. It wasn’t about control through restriction. It was about awareness through ease.

The First Week: Confusion, Surprise, and a Few Cringes

The first few days of logging every single purchase felt… weird. Like I was under a microscope. I bought a bottle of olive oil at the corner market and paused. Should I log it? Yes, I told myself. Everything counts. So I tapped it in. Then a coffee the next morning. A pack of tissues at the pharmacy. A birthday card from the drugstore. Each one felt trivial, but together, they started painting a picture.

By day four, I was shocked. I had ordered lunch three times already—and I didn’t even remember one of them. Not because I was careless, but because it happened during a chaotic work call, and I just clicked “order now” to save time. The app didn’t scold me. It just showed me: $12.50 here, $9.80 there. Small amounts, but real spending. I also discovered I’d bought almond butter twice in one week—once at the big store, once at a smaller one because I forgot I already had it. The cringe was real.

But here’s what surprised me: I didn’t feel ashamed. I felt curious. Like I was learning about myself. The app wasn’t a judge. It was a mirror. And seeing those patterns—how often I grabbed food when I was busy, how easy it was to double-buy small items—helped me understand my triggers. I started noticing the moments when I reached for my wallet out of habit, not need. And that awareness? That was the first real shift. It wasn’t about cutting back yet. It was about waking up to what was already happening.

How Daily Use Turned Data Into Real-Life Changes

After about ten days, something shifted. I wasn’t just logging purchases—I was starting to anticipate them. I’d be in the checkout line, about to buy a snack, and I’d pause. I could almost hear the app asking, “Do you really want to add this?” It wasn’t guilt. It was a quiet voice of awareness. I started asking myself, “Is this worth it?” before I swiped my card, not after.

One afternoon, I was about to order soup online because I was too tired to cook. But I opened the app first—just out of habit—and saw that I’d already spent more on takeout that week than I thought. I didn’t beat myself up. I just decided to heat up leftovers instead. That small choice didn’t feel like a sacrifice. It felt like a win. I saved money, yes, but more than that, I felt like I was making a conscious decision, not just reacting to the day’s chaos.

The app didn’t set hard limits. I didn’t have a “no takeout” rule. But seeing the data daily helped me align my actions with my values. I love good food, and I don’t want to give up convenience completely. But I also value saving for things that matter—like my daughter’s summer camp or a weekend getaway with my sister. When I could see how small choices added up, I could make trade-offs that felt balanced, not restrictive.

Another change: I started planning better. If I saw that I’d spent a lot on snacks during work hours, I began packing a small container of nuts or fruit in the morning. It took two minutes, but it saved me money and made me feel more in control. The app didn’t change my life with one big fix. It changed it with dozens of tiny, thoughtful moments.

Beyond Tracking: How It Improved My Grocery Runs and Family Budget Talks

One of the biggest surprises was how this personal tool started improving our family life. I began using the app’s grocery category to plan my shopping trips. Before, I’d walk into the store with a vague idea of what we needed. Now, I could check what I’d bought in the past two weeks. Did we use up the pasta? How much have we spent on produce? It helped me avoid buying duplicates and spot patterns—like how we went through more fruit when we had it pre-cut and ready.

But the real shift came when I started sharing the insights—gently, casually—with my partner. Instead of tense “money talks,” we had relaxed conversations. “Hey, I noticed we’ve spent a bit more on snacks lately. Want to brainstorm some easy things to keep on hand?” Or, “Looks like our grocery bill went up last month—was it because of the holiday weekend?” It wasn’t about blame or control. It was about teamwork.

We started making decisions together, based on real data, not guesses. We adjusted our meal plans, agreed on a fun monthly treat (like a new recipe kit), and even set a small family goal—saving for a backyard fire pit. The app became a shared reference point, not a personal report card. And because we weren’t arguing from emotion or assumption, the conversations felt lighter, more productive.

I also involved my older daughter in a simple way. I showed her how we track spending on activities and treats. She began understanding that money isn’t magic—it’s finite, and choices matter. She didn’t feel restricted. She felt included. And that, to me, was priceless.

The Unexpected Emotional Shift: From Stress to Confidence

The biggest change wasn’t in my bank account. It was in my mind. Before, I used to feel a low hum of anxiety every time I thought about money. Not panic, but a background worry: *Am I doing okay? Could I handle a surprise bill? Am I saving enough?* I’d avoid checking my balance, not because I was in debt, but because I didn’t want to face the uncertainty.

Now, that hum is gone. In its place is a quiet confidence. I know where my money goes. I’m not perfect—I still treat myself, I still make impulse buys sometimes. But I do it with awareness. I know what’s normal for us, what’s occasional, and what might need adjusting. That knowledge is powerful.

I don’t feel like I’m denying myself joy. I feel like I’m choosing it more intentionally. When I buy a new sweater or book a massage, it’s not a secret splurge I’ll regret. It’s a decision I’ve made with my eyes open. And that makes it more satisfying, not less.

There’s also a sense of empowerment. I used to feel like money managed me. Now, I feel like I’m managing it—gently, steadily, without drama. I’m not obsessed with every dollar, but I’m no longer blind to them either. That balance—awareness without obsession—is what I was really looking for.

Making It Stick: My Simple Routine for Lasting Results

The key to making this work long-term wasn’t discipline. It was routine. I built tiny habits that fit into my day without adding stress. My number one rule: log purchases right after I make them. If I’m at the store, I do it in the parking lot. If I’m online, I do it before I close the browser. It takes less than 30 seconds, and it keeps the data fresh.

Sometimes, I’m too busy. On those days, I use voice input. I’ll say, “Add $4.50 for coffee at Main Street Cafe,” and the app logs it. It’s not perfect—sometimes I forget the exact amount—but it’s close enough. The goal isn’t flawless tracking. It’s consistent tracking.

Every Sunday evening, I do a quick five-minute review. I open the app, scroll through the week, and just look. No judgment. Just observation. Did anything surprise me? Did we stay on track with our goals? Is there anything we’d like to adjust? It’s not a financial audit. It’s a gentle check-in with our life.

And when I miss a day? I don’t spiral. I just start again. The app doesn’t keep score. It just waits for me to come back. That’s the beauty of it—it’s forgiving, flexible, and always ready to help. Over time, this simple act of logging has become as routine as brushing my teeth. It’s not a chore. It’s a quiet act of care—for my wallet, my family, and my peace of mind.

Looking back, I realize that tracking my spending wasn’t just about money. It was about clarity. It was about showing up for my life with intention instead of guesswork. It gave me back a sense of control I didn’t even know I’d lost. I’m not perfect. I don’t have a zero balance on every category. But I’m aware. I’m present. And that, more than any number, is what makes me feel truly wealthy.